Bond Election

November 5, 2024

“Liberty cannot be preserved without a general knowledge among the people, who have a right … and a desire to know.”

— John Adams, 1765

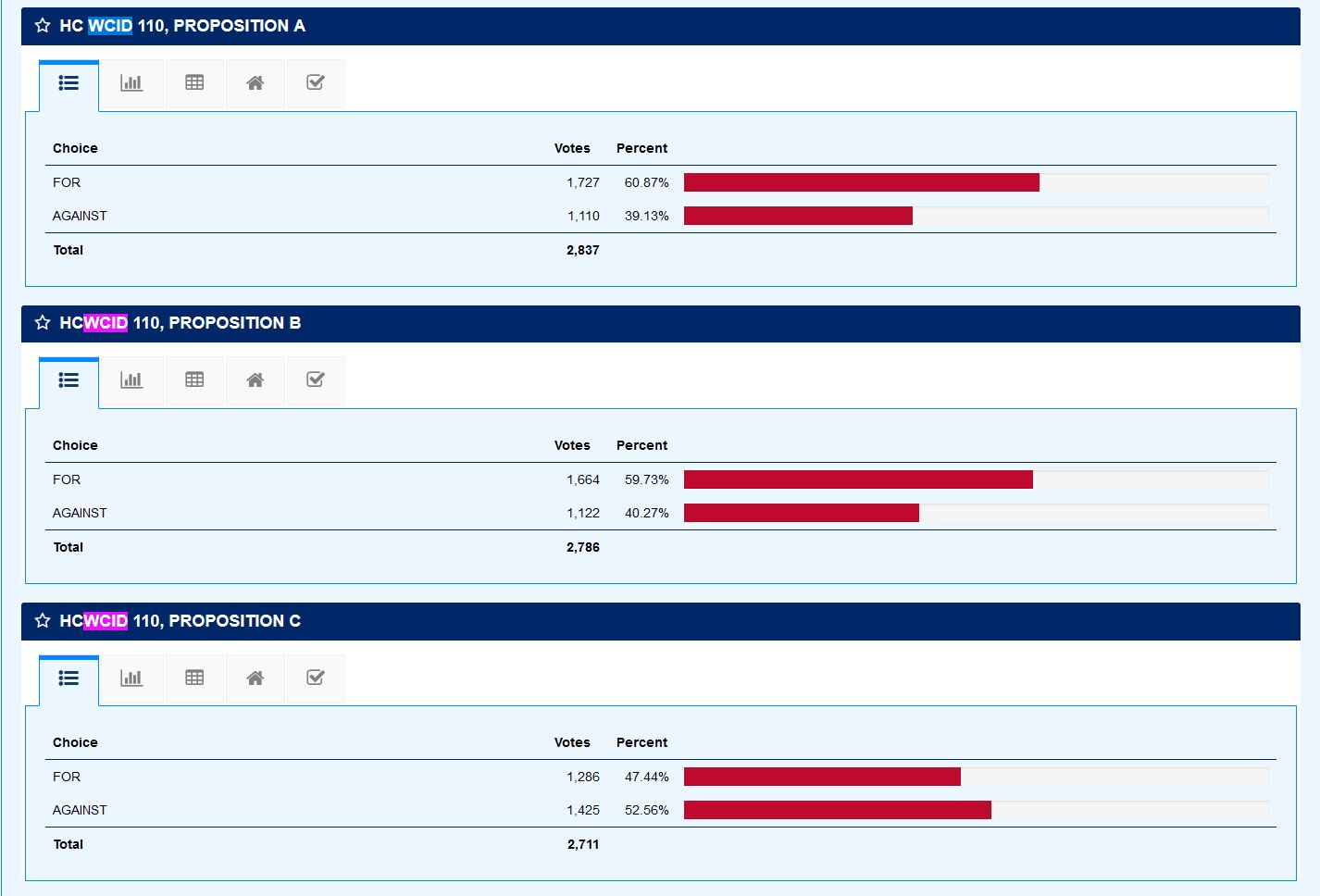

We did it hc wcid #110 residents!

Thank You WCID #110 Voters

A plea for support was sent out to each of you in an effort to better fund the district well into the future and you showed up big! Approximately 2,800 of the total 4,500 voters within HC WCID #110 voted on the three propositions.

Proposition A and Proposition B passed! Proposition C failed by a narrow margin. While a little disappointing as it was only to be used as a funding mechanism if bonds rose to unreasonable costs in the future, with the passage of the first two propositions, the district can fund future capital projects and reinforce their commitment to this district.

Look for big things to come in the district within the next 2-6 years. We should all be able to soon enjoy upgrades to our parks and amenities as well as be able to rely on our water and sewer system with the upcoming rehabilitation/upgrades.

This would not be possible without the support of each of you. Remember, the meetings where decisions affecting both infrastructure and parks are held twice a month and are open to the public. The board often has a light dinner provided given the times of the meetings. Public comment is welcomed and there is always something interesting to discuss at each meeting. You can tune into www.wcid110.com for meeting dates, times and agenda for future meetings.

Thank you all for the support!

Take Action for a Better Tomorrow

Your Vote Counts. Empower Our Community's Future.

Continue Building on the Success of Our District and Keep Our Community Thriving. Vote YES for Three WCID #110 Propositions Nov. 5th!

Join us in supporting the Harris County WCID #110 bond vote to secure a sustainable and prosperous future for our community. Your vote can make a significant difference in enhancing our water infrastructure, improving and expanding park facilities, updating Forest Oaks and ensuring long-term benefits for all residents of our amazing district.

Take Action for a Better Tomorrow

Why the Bond Vote Matters

The upcoming water district bond and tax rate vote is a pivotal moment for our community. By approving these three propositions, we can invest in critical water infrastructure improvements that will enhance the quality and reliability of our water supply while providing for efficient removal of sewage. The district assets are aging, some of them now more than 50 years old, and need upgrades. The first proposition would allow the board to take out funds to cover these expense of repairing and replacing without increasing operating costs (water invoices) or property taxes to residents of the district. The second proposition is to allow the district to sell bonds over time to cover improvements in our recreation facilities and parks. More trails, more pavilions, maybe another lake or two and lots more fish! The funds will be spent wisely, as they have for the past 56 years. Finally, the third proposition is a tax ratification item which allows the district board to adjust taxes if the bonds prove too expensive (bond rates are dependent on interest rates) and is only a stop-gap measure intended to provide a method by which the district can keep the cost to stakeholders (you) low. This initiative is not just about upgrading pipes and facilities; it’s about ensuring a healthier, more resilient future for every resident. The bonds will fund projects that address current challenges and prepare us for future growth, making our community a better place to live, work, and thrive. These three propositions also have the indirect potential to increase the values of our homes.

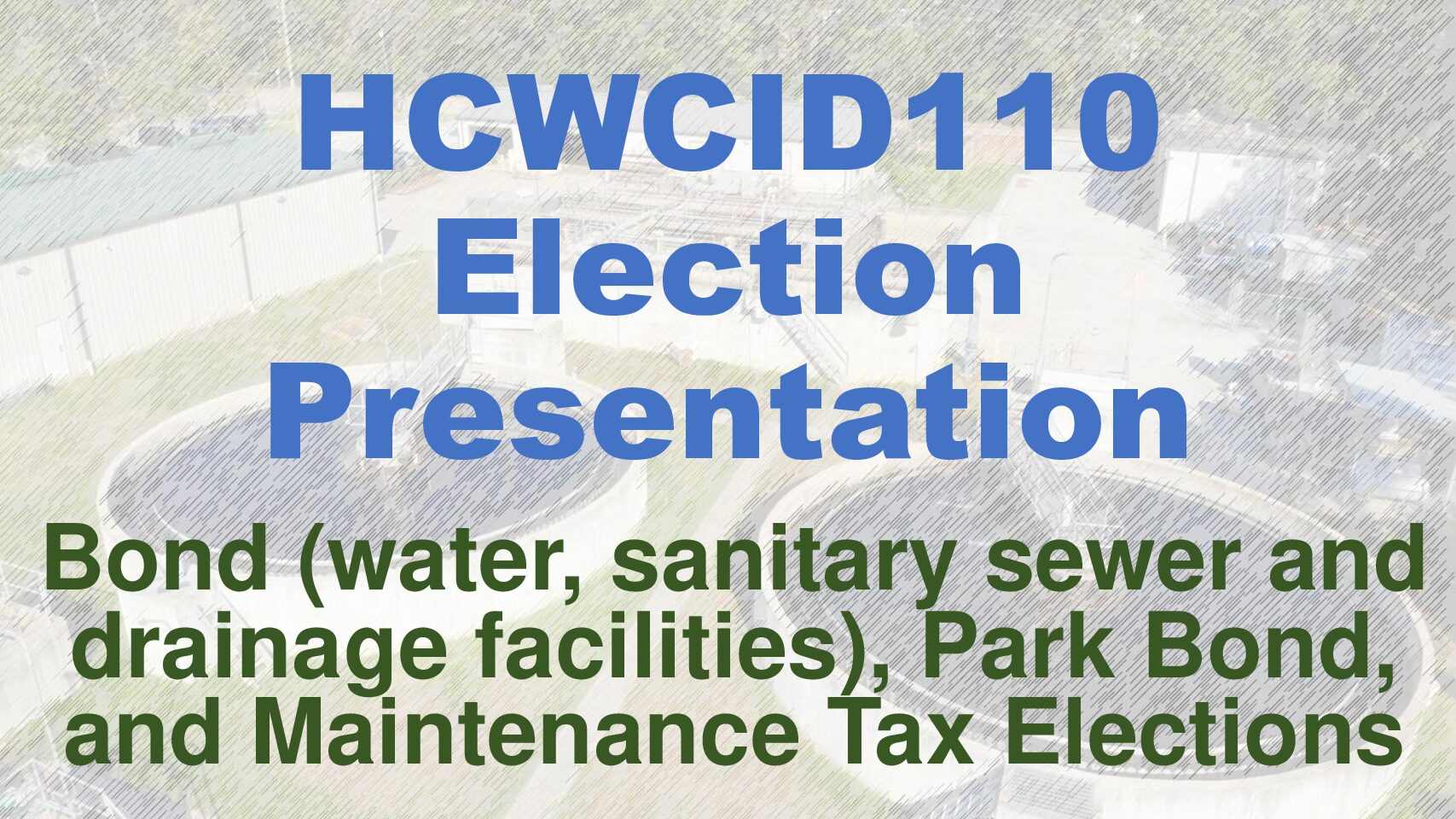

On October 9, 2024, the Board of Harris County WCID #110 hosted a town hall meeting for the public to learn more about the bonds. The image to the left is a ‘clickable’ Powerpoint presentation that was disseminated at that meeting. It can also be found on the district website. The Powerpoint is a valuable tool in determining the intent of the Board as well as the purpose of the three propositions on the November 5, 2024 ballot. Click on the image to the left and it will open up the presentation.

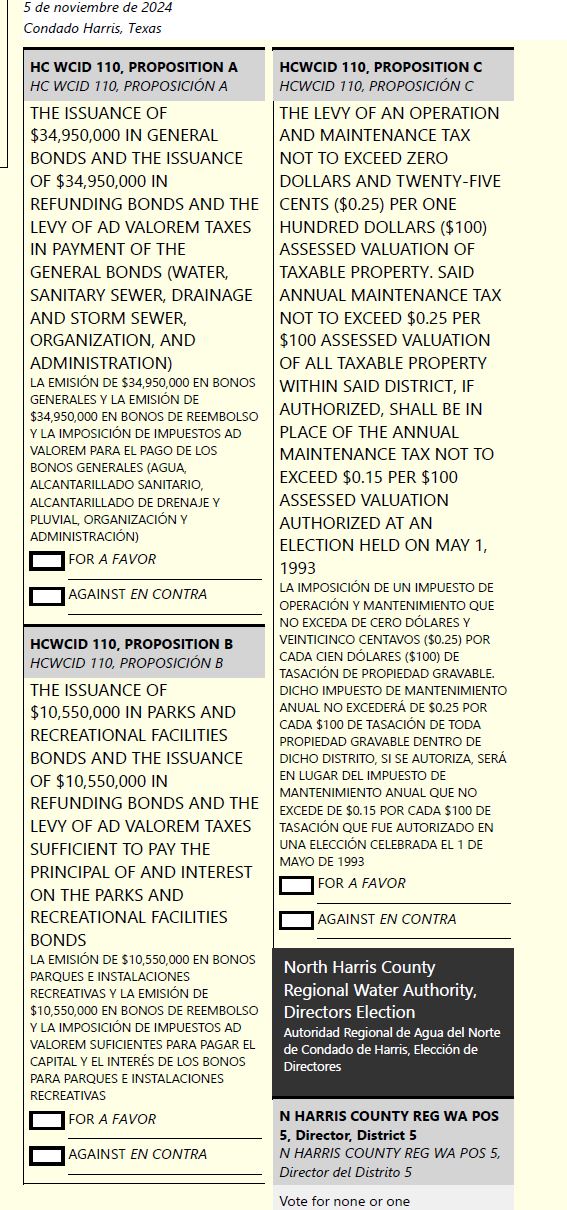

The three propositions are detailed in the graphic to the right of this message. This is exactly what you will see on your ballot on November 5th. We hope that you will consider voting “YES” for each of the three items.

A complete sample ballot can be found by browsing to www.harrisvotes.com

Your Questions Answered About the Bond Issue

What am I voting on, exactly?

The bond issues aim to fund essential infrastructure improvements, along with improvements to parks and facilities, within the Harris County WCID #110. There are three propositions at the end of the regular ballot. Two are related to the ALLOWANCE of the board for Harris County WCID #110 to issue bonds while a third proposition allows for an adjustment of the tax rate (more on that below). The first bond proposal - proposition A - allows for the board to sell bonds to fund repairs, improvements and additions to the infrastructure of the water district. The second proposal - Proposition B - allows for the board to sell bonds to fund improvements, additions and repairs to the park and recreation facilities (dog park, anyone?!). The third proposal - Proposition C - allows for an adjustment of the maintenance and operating ("M&O") tax rate and is more of a "stop gap" measure to allow for options to fund if other options prove too costly to the taxpayers.

How will the bond affect my taxes?

This is a great question. Maybe the most important one for most. Voting "YES" does NOT mean you are directly effecting an increase in your property taxes. Quite contrary. Issuance of past bonds have NOT raised taxes. Voting "YES" just allows the board of HC WCID #110 to have the option to sell bonds and/or adjust the M&O property tax rate to fund future improvements. The board, with the help of several professional consultants, has already done due diligence on this topic. The bonds are not usually sold all at once and if approved, would be sold slowly over the next couple of decades as the projects are scheduled. If improvements take place on a linear cycle, then voting "YES" means no increase in taxes whatsoever. Remember, the district has used bonds to fund growth and improvement in the district since its inception in 1968. Bonds are a way of life for municipalities and they do not translate directly into tax increases. The district has bonds currently outstanding and yet, us residents in WCID #110 enjoy an extremely low tax rate of $0.32/$100 valuation - with the highest exemptions allowed by law (20% for all and $100,000 for elderly and disabled). The board is asking you to vote "YES" on these proposals simply to provide them with the tools they need to manage the district moving forward. Their commitment has ALWAYS been to keep property taxes low as has been proven by their track record.

When is the bond election taking place? Can I early vote? Where are the locations?

The vote is included on the general election ballot and is scheduled for November 5th (7a - 7p). Early voting is from October 21 to November 1. For most in our district, the best polling place on election day (November 5th), will be Lemm Elementary located at 19039 Joanleigh Drive, Spring, Texas 77388. Early voting locations are spread out across the region. The best method to see the entire sample ballot, find the best location to vote, and determine other logistical aspects is to browse to harrisvotes.com. Make sure to check your voter registration status and polling location prior to voting.

Who can vote in the bond election?

All registered voters residing within the Harris County WCID #110 boundaries are eligible to vote in the bond and tax ratification election. Note that these items mostly benefit the residents of the district and we are the ones who get to decide upon the matter. The commercial customers, investment property owners and others with a commercial interest within the district are not able to determine the outcome of these three propositions.

Why is vote so important? What happens if the propositions fail?

A municipality needs the ability to sell bonds in order to continue efficient operations. Full stop.

If all three of these propositions fail, then the water bills are guaranteed to increase drastically. The district must undertake repairs and upgrades on infrastructure. If it cannot fund these upgrades via bonds or M&O tax, then it must pass the cost through to residents through monthly water invoices.

The district has only had a few bond elections in its 56 year history. The last was in 2007 and those funds, which were approved by voters like you and me, were just finally extinguished this year. So the board needs the 'permission' to issue new bonds in the future.

If the vote for this fails and the district finds they need significant funds for improvements - which a certainty exists that funds are needed to keep a 50+ system running - then the only option left to fund these improvements would be drastically raising the M&O component of property taxes (OR) passing the expenses through to property owners through monthly water bills. So if the district cannot have the ability to lend to fund large projects, then anticipate water bills to increase significantly in the near future. There are two propositions - Prop A and Prop B - that allow the board to issue bonds. The third proposition - Prop C - is a fail-safe in the event the bond propositions fail (OR) if when the funds are needed in the future, it is found that it is cheaper to fund projects through M&O property tax vs. issuing bonds (common in times of expensive bonds).

Assuming the worst that all three propositions fail voter approval, then the district would have no option but to increase monthly water bills and/or cut services back drastically.

Does Proposition C mean taxes are going to rise? I mean, what is the purpose of Proposition C outside of that concern?

NO! The manner in which Proposition C reads on the ballot is a bit confusing and worrisome.

Voting "YES" only allows the board the option to increase the M&O component of the property tax. It is not a guarantee the board will do so nor does it force the board to do anything at all. By voting "YES", you are allowing the board an extra option, a tool, to be used in the future if it means cheaper funding of improvements outside of issuance of bonds and/or increases in water rates/monthly water bills.

Let's say we have to replace the water plant - which is being considered given its age - at the cost of $5mm. If Prop A passes, then the board would have the option to sell bonds - debt instruments paid over 30 years - to pay this $5mm. Yet, what is the interest rate for bonds is 12%?? That could get pricey and would elevate the debt service component of the property taxes - something the board does not want (they pay taxes here too). Instead, they could raise the M&O rate slightly, while the debt service rate would likely decline due to no bonds, and fund the improvements through a few extra pennies there.

So by voting "YES", all you are indicating is that you trust the board to keep doing the right thing and allowing them an extra option in the event other options, such as bond issuance, are more costly.

Why is this topic coming up now? We haven't had a vote on bonds or tax adjustments in many a blue moon.

2007, actually. That was the last election to allow the board to sell bonds. It passed and since that time, the property tax rates have continued to fall. Tax election? Last one was 1993. Yep, just over 30 years ago.

To answer the direct question, the vote is on the November 2024 ballot because the board just recently sold the last of the bonds allowed by the vote passed in 2007. As with any business enterprise or municipality, especially ones dealing with manufacturing equipment, the infrastructure will always need to be repaired and improved. While the district has done an amazing job paying for a large portion of improvements in the past many years using operation revenue (saved us taxpayers millions of dollars in expense doing this versus other means), the board needs to have the option to issue more bonds in the future for repair, improvement and new construction projects. It may be many years before the first bond from this election, if passed, is sold, but voting "YES" allows a funding mechanism for the board to pay for this work instead of having to inflate the water bills and/or charge more property tax.

We get one chance at this. Please consider voting "YES" to show the board and the community you want these improvements and support and trust them based on the decisions to this point ($0.32 tax rate and crazy high exemptions - wink wink).

Aren't bonds debt? Debt is bad, right?

Bonds are indeed debt. Not all debt is bad. The debt being presented here is a very healthy amount and if handled properly, will result in no increases in property tax. It really comes down to trust. Do you trust the board and their consultants to act in your best interest with the options presented? It is basically the same board and group of consultants the district has had for decades. So the argument would be that you've given trust in the past and it's been ok, so why not extend it again on these three propositions?

Bonds aren't necessarily bad, especially when working within the municipal sector. Rates are often lower for lending via bonds due to financial stability, and low risk, of the underlying municipality. The most important aspect of bonds is that they help "soften" the cost of large capital improvements such as necessary water plant improvements and sewer plant expansions.

It is important to note that HC WCID #110, like all water districts, MUST keep the water and sewer flowing. The age of the district is such that many large expenditures for upgrade and replacements are upcoming. The methods by which the district can fund these expenditures are: charge back to users through the monthly water bills, issue debt to finance the expenditures over time, raise the maintenance and operating (M&O) component of the property tax; or a combination of all of these. If these propositions do not pass, the only option that the district would have would be to charge the repairs through the monthly water bill. Can you imagine receiving a $400 water bill each month? That is possible and is occurring in several districts where bonds were rejected. So imagine that same expense being pushed through bonds and being paid over a 30-year term. This leads to softening of the effect of any improvements and additions to the district.

Further, these bonds are paying for upgrades and improvements, such as new parks and facilities, that should directly translate into better home values and quality of life for all of us. So this is debt that can be tolerated and that is appropriate in this case.

Is it true that if these propositions pass, I could somehow get a tax deduction on my personal tax return?

There is most certainly that possibility. If these propositions did not pass and the improvements were billed through the monthly water bill, it would almost certainly not be deductible (only deductible to some commercial enterprises). However, for those who itemize, there is currently a deduction allowable for most of up to $10,000 for property taxes paid. So for some, this could result in a reduction of income tax liability.

This does not constitute tax or legal advice. Every tax situation unique and it is advised that you speak with your CPA or tax professional to determine if your property taxes would be deductible and to what extent.

How do bonds work, exactly? The district is asking for my approval for about $45 million dollars of bond debt. Do they just go out and sign a loan and "sit" on the money until the projects are ready to move forward? Who approves the debt and how?

No. If the bonds pass the stakeholder vote, then the board does not have to issue the debt immediately. The vote is similar to allowing the board a "line of credit" that they can draw from at a future date. Upon being given approval by the stakeholders (us!), the board would plan out the projects over the next many years. It may take up to a decade and the board and consultants would decide the best timeline. Remember, the board just sold their last bond from the 2007 bond vote!

Once the projects are well into planning phase, the board applies for a certain amount of bond debt via TCEQ (and few other regulators). This amount of debt will likely be in tranches or "bunches" of applications. The board may decide to apply for $5mm at a time. The timing of when the debt is actually issued is dependent on the need, the operating surplus to be used by the district, and the interest rate to be charged on the debt. HC WCID #110 is fantastic at avoiding bonds and saving money by using operating expenses for capital improvements - saving over $2mm in past decade alone using this method. So selling the packets of bonds, in partial amounts, allows the district to both only use what is needed immediately and assists in controlling overspending. With $45 million in total bonds, it may take 15 years or more to use it all for the intended purposes. That means savings to each of us taxpayers.

The district has a detailed forecasting matrix and plan which allows them to control what projects to undertake and when in an effort to keep our property tax and operating expenses as low as feasible.

Is approving bonds like writing a blank check to the district and the board?

Absolutely not! As was stated above, there is a very complex approval process with layers of different regulatory agencies examining the bond instrument for compliance and application before it is even put on the market to be sold. The district must state EXACTLY what the purpose of the bond is and justify the reasoning. No vague responses or projects are allowed.

The district would not get past the first layer of regulatory scrutiny with "we need to build new water assets....." Instead, the state will want to know exact details. That last example would look something like,"....these bond proceeds are to be used for only plant expansions at the corner of Enchanted Oaks and Cypresswood including two pumps, new wellhead, new storage facility of XX thousand gallons to be constructed between March 2025 and January 2026. Please see the gazillion construction documents attached." Even that is oversimplifying. The point is that bonds must be specifically purposed and the regulatory agencies are strict about only allowing them to be used for capital projects that benefit the stakeholders.

Once put to market, the potential investors again inspect the purpose of the bonds and the district itself to ensure they are not investing in a bad security. Investors will not buy bonds with low anticipated yields/rates unless they know there is low risk. Many will not purchase bonds from risky municipalities.

Bonds represent anything BUT a blank check. They are specifically purposed for certain capital improvement projects and get great scrutiny in the process of approval.

What exactly are the monies requested in Proposition A going to be used for?

A. Water Plant No. 1 Improvements $3,500,000

B. Water Plant No. 2 Improvements $1,050,000

C. Water Distribution System Improvements $6,300,000

D. Wastewater Treatment Plant Improvements $2,800,000

E. Wastewater Collection System Improvements $3,225,000

F. Storm Sewer and Drainage System Improvements $6,300,000

G. Contingencies $3,476,250

H. Engineering/Surveying $4,797,225

What exactly are the monies requested in Proposition B going to be used for?

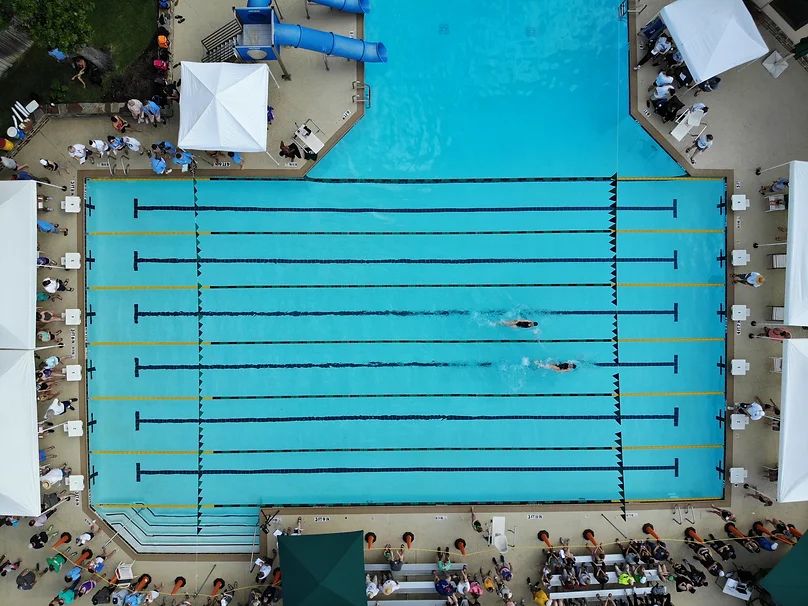

• Forest Oaks Swimming Pool Rebuild - Pool is 30+ years old (with consideration of tear down and rebuild of entire pool house to update/maximize space potential)

• Construction of two new pavilions on new lake.

• Increased expenses for annual fish restocking.

• Expansion of reclaimed water system for lakes and irrigation systems.

• Expansion of power lines to all pavilions and high traffic areas within the park.

• Replace and upgrade security systems.

• Additional covered benches and swings throughout the park along lake banks and walking paths.

• Replacement cycle for wooden bridges.

• Additional of lake fountains in all lakes to improve water circulation.Construction of new Tennis Pro and Storage Building and redesign and beautification of current tennis shed area.

• Replacing decomposed granite walking paths with asphalt or concrete.

• Construction of additional park bathrooms.

• Construction of dog park.

• Construction of pickleball court complex.

• Construction of new larger pavilion for large group events/rentals.

• Erosion mitigation along Cypress Creek banks.

• Safety barrier along Cypress Creek side of park

• Land acquisition for new park space, amenity lakes, and other possible amenities like a dog park, pickleball courts, disc golf course

• Additional outdoor fitness areas within the park to include outdoor fitness equipment.Repurpose main pavilion to be used for covered pickleball court(s).

• Additional practice backboards.Tennis courts 5-8 resurfacing

• Tennis courts 5-8 light replacement with MUSCO lights

• Fitness Center – equipment replacement plan for all cardio and strength equipment – almost all equipment was replaced after Harvey in 2017 so starting a replacement schedule will allow us to spread out the cost over multiple years. Data on equipment usage for cardio equipment is a major factor in replacement schedule.

• Replacement of audio system for pool area.

• Addition of new deep-water amenity to replace old rock wall.

• Replacement cycle for new outdoor tables and pool deck chairs/loungers.

• Replace and upgrade security systems.

What about the commercial properties in our district? Do they have a say in the vote? Do they fund any of these improvements?

The commercial properties must absolutely be considered in this evaluation. Of the total taxable value of the district, the commercial properties comprise 47% of that valuation for 2024. That means 47% of the taxes for our district are paid via commercial property owners. However, they have no say in the vote nor do they decide how the funds are spent. We the voters, the residents of HC WCID #110, get the sole vote. This is a good check method to ensure responsible development and it allows, to some extent, control by residents as to what is allowed for development in the area. Further, the commercial property owners are NOT allowed the same generous 20% property tax exemption ($100,000 for elderly and disabled). We the residents of HC WCID #110 get to make the decisions for all entities and that is why your vote is so important. Please consider voting "YES" for all propositions related to HC WCID #110 so that we can have the resources we need to continue the amazing amenities we have become accustomed to.

Where can I find more information about the bond?

You are welcome to reach out to me, Scott Hubert, directly. I will be honest in my responses to any questions you might have and be objective in answering any questions and concerns not addressed here. You may also seek out exact language for the bonds at wcid110.com. Finally, you can reach out to the Forest Oaks office at 281-353-0998 and speak to Brian Mills or Denise Simples regarding these votes.

Key Benefits of the Bonds

Infrastructure Upgrades (Prop A)

Replacing aging infrastructure such as water and sewer plants, underground supply lines and the pumps and apparatus that support the entire water and sewer system. These upgrades to facilities prevent leaks and service disruptions, ensuring a reliable water supply. For more information on infrastructure upgrade plans, click the heading above.

Voting "YES" On Each Proposition Allows Monthly Water/Sewer Invoices to Residents to Remain Low

Many of the improvements being discussed will have to be undertaken whether the propositions pass or not. If the propositions pass, it not only allows for a continued competitive property tax rate, but also contributes to a lower monthly water/sewer bill. If these propositions do not pass, the only funding mechanism for repairs and upgrades would be through water and sewer billing.

Bonds Will be Issued Over Long-Term With Intended Effect of Zero Property Tax Increase

The district has used bonds since its inception. The district currently has bonds outstanding. Yet, the tax rate is a low $0.32 per $100 valuation. The intent of bonds is to allow for continued balancing of improvement funding so that the rate remains low. This financing of improvements also ensures a better a chance of continued aggressive exemptions as are offered currently.

Construct New Parks, Recreational Facilities, And Improve The Overall Amenities of HC WCID #110 (Prop B)

Proposed projects include swimming pool rebuild, construction of new tennis pro and storage buildings, construction of new pavilions, construction of new lakes and walking trails on recently acquired Hendricks land (14.5 new acres purchased Aug 2024), construction of a dog park, construction of pickleball courts, and the possibility of dozens of other improvements. See details of proposed plans by clicking the heading above.

Community Health and Security

Reducing health risks associated with outdated water systems, promoting overall well-being. Further, the bonds can be partially purposed to pay for security and security devices that help protect those within our district. This is very important with the rabid growth of our area. Without security, we are all in peril and would be left to our own devices.

Future Preparedness

Building a robust infrastructure that can support our community’s growth and development for decades to come. The infrastructure and parks are two components, but it is important to realize that future plans for security, flooding prevention, drought preparedness, storm preparedness and other tertiary services are included and attached to these three propositions. The three propositions being passed can have a significant impact on how our communities develop and the home value trajectory of the future.

Community Voices

★★★★★

“Clean water is a right, not a privilege. We are going to have to pay for the upgrades in one way or another. I’d rather continue using the manner we’ve utilized for decades and finance the work through bonds. My understanding is that we would have huge water or property tax bills without the passage of these propositions.”

Brenda C, Cypress Forest/HC WCID #110 Resident

★★★★★

“I trust our board. They have proven time and again that they can use taxpayer funds responsibly. We have much more then most any other districts – parks, low taxes, Constable service, free debris cleanup, and dependable services. Why would I tell them ‘no’ when they’ve told us ‘yes’ so many times in the past? I trust the board is going to always do the ‘right thing’.”

Mary A, Enchanted Oaks/HC WCID #110 Resident

★★★★★

“We have it really good in this neighborhood. Outside of traffic along Cypresswood, this is one of the best areas of Spring in my opinion. We have a lot to be grateful for because of our water district. I feel they do more than most. I especially appreciate them picking up two trees from my yard after the hurricane (Beryl).”

George P, CFL/HC WCID #110 Resident

Proposition A - Vote Yes for Water/Sewer

Proposition B - Vote Yes for Parks and Recreation

Proposition C - Allowing $0.10 Increase in M&O Rate

%

Board Commitment to Continued Progress & Low Property Taxes

Make Your Voice Heard

Join us in shaping a sustainable future for our community. Vote ‘YES’ for the three HC WCID #110 propositions on election day to ensure clean water, efficient sewer service, better parks and facilities and robust infrastructure for generations to come. Your vote matters!